High oil prices are detrimental to the economy as it will raise cost of living and cost of production and thus, undermining the growth of the economy. It is therefore critical for the government to derive solution to solve the problems and one such solution is the implementation of subsidy which may not be the best solution to solve the problem of rising oil price.

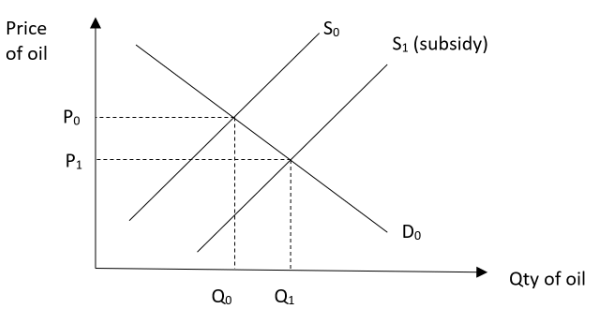

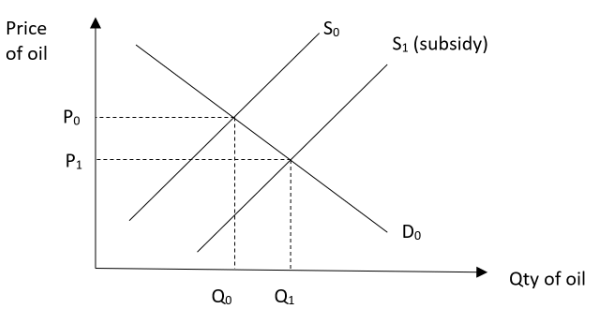

Provision of subsidies to the producers will lower the cost of production to enable the producers to lower the prices of oil. This will enable the producers to lower the price level of the oil and thus, allowing the consumers to maintain a higher level of demand while attaining it at a low price level.

As seen from diagram 1, price level is lowered from Po to P1 after the increase in supply as a result of the provision of subsidies to the producers.

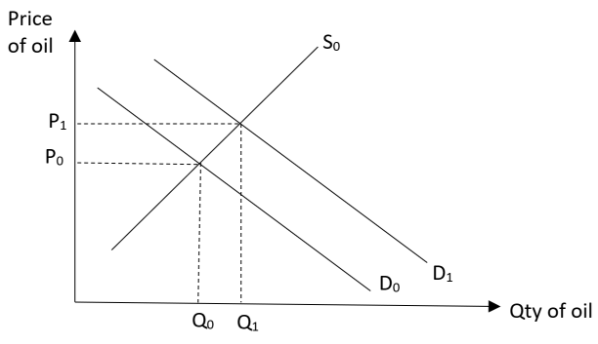

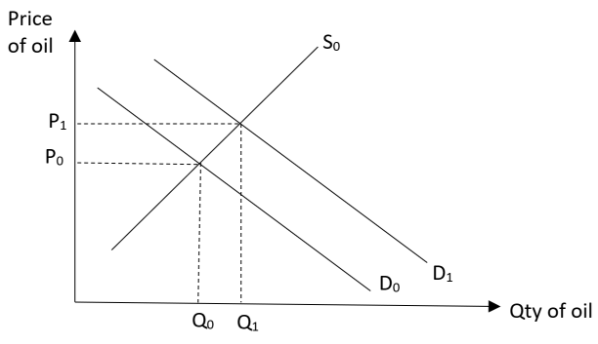

Provision of the subsidies to the consumers will increase the purchasing power of the consumers and thus, enable them to maintain the level of consumption despite the high price level.

As seen from diagram 2, the increase in demand to maintain the level of consumption at Q1 despite the increase in price of oil.

Subsidies have strong inducement on the supply and demand condition as it provides monetary benefits to the consumer and producers. Subsidies will also raise the benefits of the consumers as it expands the purchasing power of the consumers and thus raise the standard of living or lower the cost of production.

However, subsidies will increase the cost of government expenditure as it will lead to the need to increase tax or government borrowing which will increase the tax and debt burden. An increase in tax will contract the growth of the economy and discourage work effort while debt burden will increase the burden of the future generation or deplete the future earnings. Subsidies will also encourage excessive consumption which will lead to further increase in demand and thus inducing further rise in price level, nullifying the benefit of subsidies. Subsidies will only benefit the higher income group more as it is given out cross the board to all consumers without the consideration of income disparity (petrol is used more by higher income group). Subsidies given to the producers may not decrease the price of oil if the producers do not pass on the subsidy benefits to the consumers.

Although the policy of subsidies is useful and impactful, the detrimental effects outweigh the benefits and thus, it may not be the most appropriate solution.

Besides subsidies, the government can impose taxation, set regulations on the usage of petrol and develop better resource management and utilization.

One alternative solution is tax imposition. It will discourage consumption as the price will increase. This may increase the price of oil but future reduction in the demand of oil will help to dampen the rise in oil price. Such an approach is effective in dampening oil prices in the long run as it will help to correct the consumption behavior and thus better optimize the utilization of oil as there will be no excessive utilization. It will also force the consumers and industries to cut down wastage of oil or switch to the production or usage which will demand for more usage of oil.

Another alternative solution is the use of rules and regulations. The government can regulate the usage of oil by imposing regulations on the various types of consumption which will increase the demand for oil such as the usage of cars. For example, the government can set regulation on the number of cars on the road based on the number plate whereby odd number plate are used for certain days while even number plate are used in other days as seen in France. Such regulations provide direct intervention of the consumption, making it more forceful and direct in controlling the quantity of consumption. However, such form of regulation requires extensive administration which will incur higher cost of production. The rules can be violated by the consumers as consumers can simply own two cars to overcome the restriction on road usages and thus, rendering the solutions ineffective.

Lastly, the government can also help the industries by providing the infrastructural support that will help to reduce the usage of oil. The government can provide subsidies to help the industries to switch other alternative sources of energy production. The government can also create stockpiling to influence the market production and consumption and this will enable the government to maintain the price level at reasonable low level. However, the solutions mentioned are for long term and may not be feasible to solve the sharp rise in price of oil in the short run. It is costly for the government to introduce such regulations as the government needs an effective administrative body to regulate the policies. It is also quite impossible for the government to impose stock-piling as the nations may be price-takers and have very little control of the supply.

In conclusion, it can be seen that the solution of subsidies can be a solution in the short run to help to solve the problem of high oil price. The problems of high oil price can only be solved with the complementary use of different policies to optimize the impact.