In general, a perfectly competitive market is characterized by the fact that no single firm has influence on the price of the product it sells. A perfectly competitive market has several distinguishing characteristics: there are many buyers and sellers in the market; the commodity sold is homogeneous; there is free entry and exit from the industry; perfect mobility of factors of production; transport costs are assumed to be negligible; both buyers and sellers are independent in their decision making and there is perfect knowledge.

Due to the fact that there are many buyers and sellers in the market and a homogeneous product, no single buyer and seller can control the market and therefore has no influence over the market price of the product. Examples of perfectly competitive firms are vegetables stalls and money changers. Price is determined by the market forces of demand and supply and each has to accept whatever price that is prevailing in the market. Both the sellers and buyers are price-takers and there is only one market price at any one time. It is not possible for the seller to increase the price of the product by reducing his output as his clients can easily turn to other sellers. Similarly, no single buyer can have the ability to reduce price as he is only of the many buyers. Because of the vast number of buyers and sellers, buyers do not receive any preferential treatment. In addition, because the commodity is identical in the eyes of the consumers and they will not be able to tell whether the product comes from firm A, firm B or firm C. Products from different firms are perfect substitutes for the consumers, therefore, they are not prepared to pay more than that is prevailing in the market. Because of the homogeneity of the product, no firm can increase or decrease the price of its product above or below the market price without serious effects on its sales. If the seller were to increase price, he will lose all his customers as they can turn to other firms. Therefore, a perfectly competitive firm is a price taker and hence its demand curve (AR) is a horizontal straight line and also MR = AR = price.

As a perfectly competitive firm is unable to determine price, it will seek to determine the output that will maximize its profits. There are two approaches to achieving profit maximization. Firstly, the total output approach where the firm aims to produce the level of output at which (TR- TC) is maximum. The second approach is the marginal approach where the firm maximizes its profits by producing up to the level of output where MC = MR. (MC must cut MR from below). MR refers to the change in a firm's total revenue arising from the sales of one more unit of the product while MC refers to the increase in the total cost arising from producing the one more unit. If MC > MR, reduce output; If MC < MR, increase output.

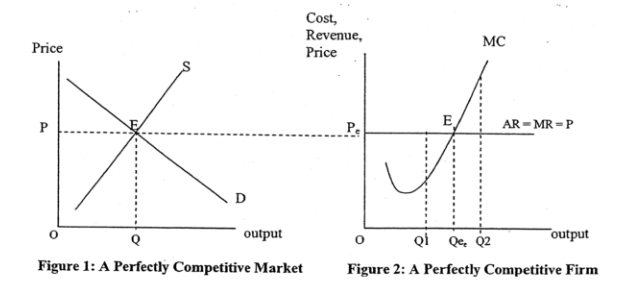

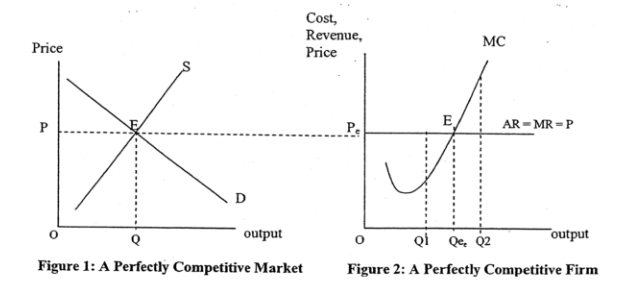

Figure 1 shows a perfectly competitive market where the equilibrium price and quantity are determined by the interaction of the market demand and market supply. OP is the market-clearing price and this price is then taken by each of the firms. Because the market price is constant for each unit sold, the AR curve also becomes the MR curve. A firm maximizes its profits when MC = MR. The equilibrium output for the firm is thus OQe i.e., the firms sells OQe quantity at OP price.

With reference to Figure 2, profit maximising or equilibrium occurs when MR = MC at OQe where the last unit of output adds on as much to the firm's revenue as it does to the cost. Therefore the profits cannot be increased further and thus the firm has achieved maximum profits. At OQ1, where MC < MR, the firm can increase its profits by expanding production to OQe since the additional cost arising from producing one more unit is less than the additional revenue from the sales of one more unit. On the other hand, at OQ2, where MC > MR, in order to maximise profits, the firm should cut down production to OQe as the additional cost arising from producing one more unit is more than the additional revenue from the sales of one more unit.

In conclusion, as the firm in a perfectly competitive market is unable to determine the price in the short run, it will seek to determine the equilibrium output that would maximize profit by producing at MC = MR. In the long run, due to freedom of entry and exit of firms in the industry, the PC firm will have to adjust its output accordingly. In the worst scenario, where the AR < AC in the long run, the firms will have to shut down. However, perfect competition is a static model and the assumptions are most unlikely to be found in the real world.